This millennial couple makes $130,000 combined. With a baby on the way, a mortgage and car debt, how can they prepare?

EVELYN KWONG SEPTEMBER 06, 2021

Millennial Money is a weekly submission-based series that provides financial advice to millennials.

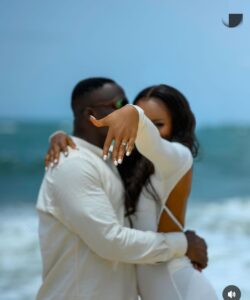

After more than a decade of dating, Matt, 33, and Elicia, 29, are about to enter a new chapter of their lives. In 2020, they hosted a small pandemic wedding, saving on costs for the ceremony and reception. Now, Elicia is seven months pregnant.

“We took the opportunity of the pandemic, when we were saving money, to do what we’ve always planned to do,” Elicia said. “Finally made the jump out of our parents’ homes.”

The years spent living with their parents helped them to save enough to put a down payment on their first home in early 2021: a townhouse in Pickering.

Working two essential jobs, as a registered nurse and as a stock manager at a meat processing plant, Matt and Elicia earn a combined income of $130,000, with monthly take-home pay of $6,100. While that may be enough for a couple, they know that they’ll have to prepare to save for child-care costs soon.

“It’s our first time living on our own, and we’ve been quite good. It’s hard to plan but we know a child is going to be expensive,” Elicia said, adding that since moving out, they’ve trained themselves to eat most meals at home. “We’ll usually meal prep, but once or twice a month we might buy a small breakfast or coffee for under $10.”

Because of the long hours at work for both, dinners are typically a mix of cooking and takeout — with to-go meals costing around $15 per entree. “We typically spend $100 on weekday dinners in a month, and $100 a week for weekend dates.”

Though they just moved into the townhouse, they’re planning to eventually have more kids and know that they’ll need more space.

“Our goal is to eventually purchase and upgrade to a bigger home in the next five years,” Elicia said. “Ideally we hope to be able to rent out our current home, after moving into a new home.”

On top of paying off the townhouse, they have around $2,000 in credit card debt and $31,000 for their car lease.

To get a better idea of their day-to-day finances, we asked them to share a week in spending.

The expert: Jason Heath, managing director at Objective Financial Partners Inc., on the couple’s finances.

Congrats to Matt and Elicia who are about to become parents. Speaking from personal and professional experience, kids are a treasure, but they can also present some financial challenges. Matt and Elicia’s household income will decrease if one or both takes a parental leave, and their expenses will also increase. Daycare in particular is a big cost until a child starts kindergarten, and can cost upwards of $2,000 per month.

Matt and Elicia lived quite frugally with their parents during their 20s so they could save up to buy a townhouse in Pickering. They would like to move to a bigger home in five years and keep their townhouse as a rental property. This seems to be a common goal for many young couples I come across.

I suspect Matt and Elicia have most or all of their net worth tied up in their home value as it is, so they may be better off diversifying into the stock market. The opportunity to take advantage of the tax reduction and deferral of RRSPs or the tax-free growth of TFSAs could also be advantageous in the long term. This is not to say that stocks are going to be a better investment strategy than rental real estate. But going all in on one or the other may not be as good a strategy as owning a bit of both.

They have continued some of their frugal ways, meal planning and bringing lunch to work. Meal planning can help avoid the recurring costs of eating out but also saves money on grocery bills. Food waste costs are estimated at $1,766 per year for Canadian households, according to Second Harvest.

Matt and Elicia should consider their life and disability insurance coverage given the new addition to their family. If something happened to either of them, they would want to be sure their family was not in dire straits.

They can consider a RESP for their child to save for post-secondary education. Up to $2,500 per year of contributions are entitled to a 20 per cent government grant and investment growth is tax deferred. Grant room carries forward so they can catch up in the future, especially if cash flow is a little tight over the coming year depending on their parental leave plans.

Results: They spent less. Spending in week 1: $423 Spending in week 2: $415

How they think they did: Jotting purchases has enabled them to see clear proof of their day-to-day finances, and the goal this week for Elicia and Matt was to spend less.

“This week we definitely tried to be more cautious of our spending,” Matt said. “Learning how much the average cost of wasted food was made us more aware of our unnecessary spending and be more cautious of what we bought for groceries.”

Take-aways: In addition to seeing how their money is spent on food, the two say they will make changes to quick purchases in the future.

“We now want to eliminate buying fast food or takeout, especially with food already at home, and avoid wasting,” Elicia said. “Bulk buys, easy and quick recipes are things we have been researching in hopes we can expand our cooking skills while saving money.”

A point of reassurance for the couple is the affirmation of long-term advantages of saving in TFSA and RRSP accounts.

“With our first child on the way, it was extremely helpful learning about the several ways we are able to prepare for our child’s future financially,” Elicia said.

Moving forward, they’ll be looking into an RESP fund for their child to help save for their post-secondary education.

“Our lives are about to drastically change, especially from a financial standpoint, so learning about the different ways we could spend, save and invest was extremely helpful,” Elicia said.

Like Our Story ? Donate to Support Us, Click Here

You want to share a story with us? Do you want to advertise with us? Do you need publicity/live coverage for product, service, or event? Contact us on WhatsApp +16477721660 or email Adebaconnector@gmail.com